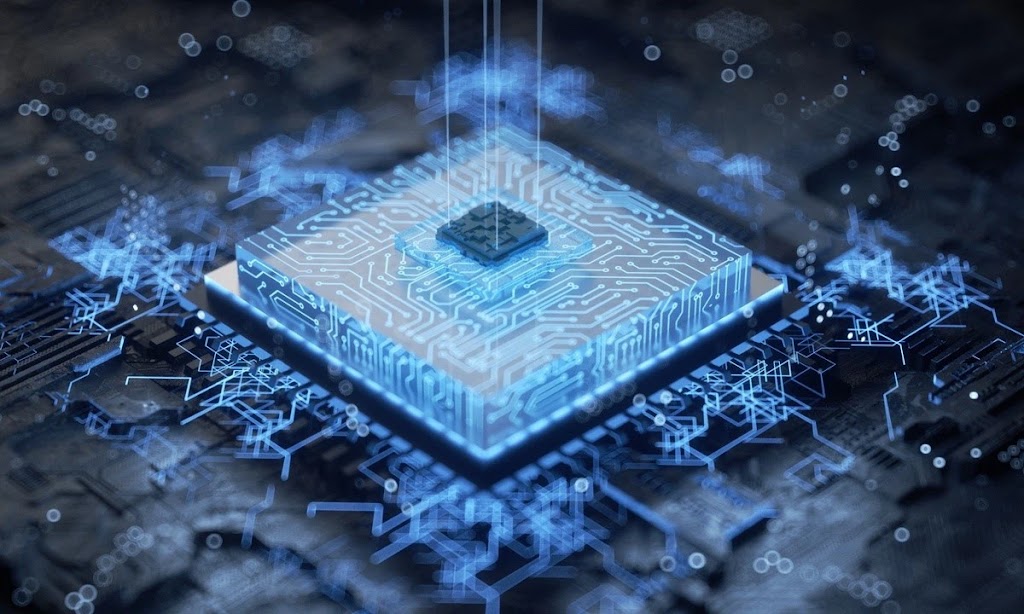

Forced to sell Ventai

Technology to NWF

Vantai Technology has announced that, following the British

government’s “national security” requirement for Vantai Technology

almost a year ago, it plans to sell all of its equity in its NWF wafer fab

located in the UK.

According to the announcement, Ventai Technology’s wholly-owned

subsidiary, Anshi Semiconductor, has identified the ultimate buyer for 100%

equity of its subsidiary NEPTUNE 6 through a competitive bidding process within

a specified scope.

NEPTUNE 6 is NWF’s parent company. The acquiring party is

Siliconix, a wholly-owned subsidiary of Vishay, which is a company listed on

the New York Stock Exchange. The transaction amount is based on a base price of

$177 million, including the target company’s loan from Anshi Semiconductor. If

the transaction is successfully completed, it is expected to generate

approximately $53 million in investment proceeds for Vantai Technologies.

Vishay is a manufacturer of discrete semiconductors and passive

electronic components, the data shows. As of 30 June 2023, Vishay has total

assets of $4.187 billion, with a net worth of $2.214 billion. Revenues for the

first half of this year (January to June) are $1.763 billion, with a net profit

of $207 million.

Regarding the aforementioned incident, on November 9, Wentai

Technology officials said in an interview with the media that the forced sale

reflects the pressures and challenges Anshi Semiconductor is facing in its

global development process and that it Indicates the responsibility and

commitment. The management team.